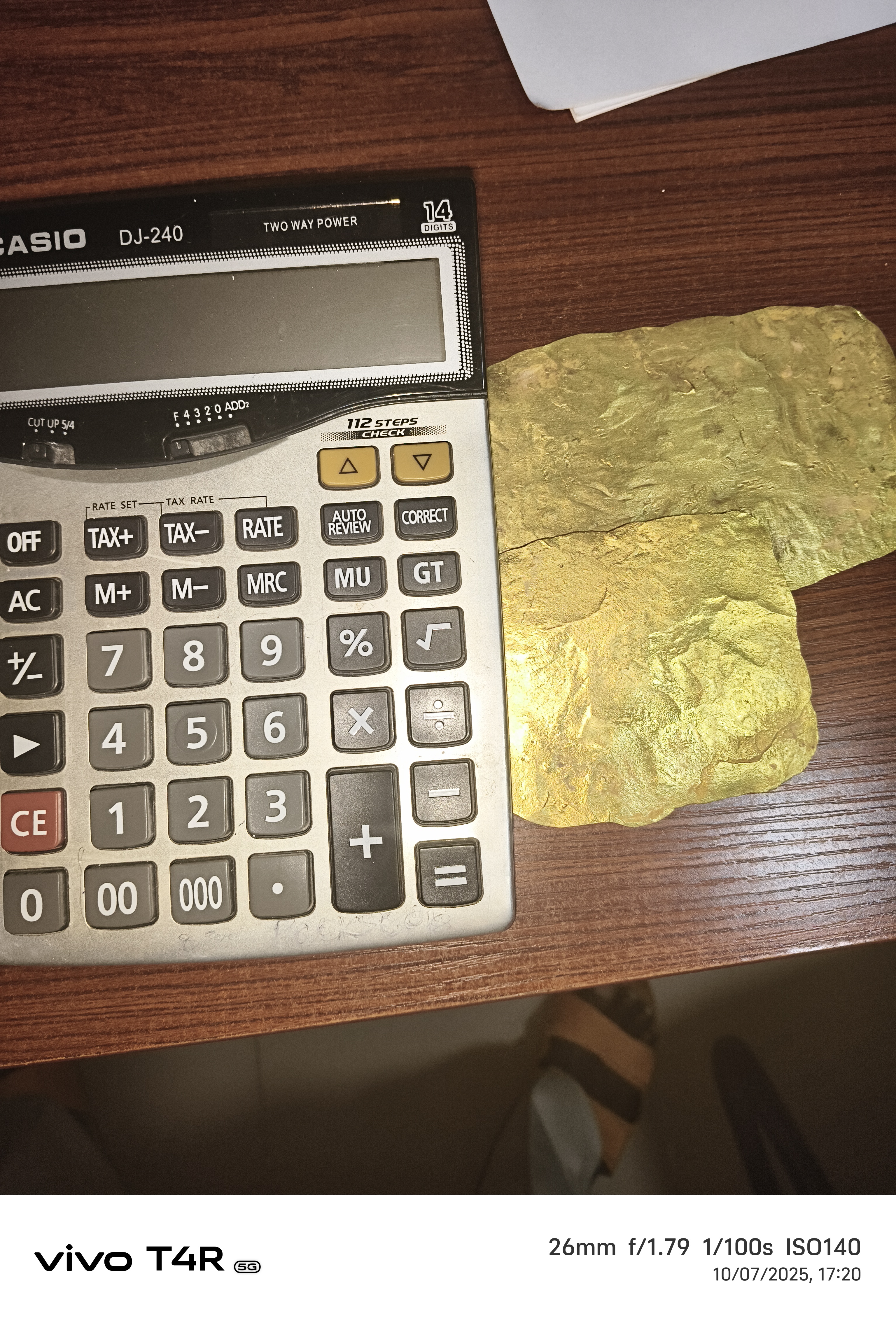

Gold has experienced a relatively successful year thus far, with a single instance in which it exceeded $3,400 per ounce, a record for the precious metal.

However, circumstances have evolved in recent weeks. Gold prices have been volatile, with a low point of approximately $3,200 in mid-May, due to the ever-changing demand for safe-haven assets and diversification, oscillating Treasury yields, and shifting inflation expectations.

Although gold prices have already begun to recover, it serves as a timely reminder that the gold market is subject to constant fluctuation, particularly in the current unpredictable economic environment. If you are considering investing in gold (or any asset, for that matter), it is imperative to have a clear understanding of what may occur in the future.

Would you like to guarantee that you are adequately equipped to make the appropriate decisions regarding your portfolio this summer? We solicited the opinions of several experts regarding the potential fluctuations in gold prices during the month of June.

The following are three potential gold price scenarios that could occur this June, as well as the circumstances under which these scenarios could become a reality.

The price of gold may stabilise.

The experts we consulted anticipate that the gold market will remain relatively stable for the majority of June. First and foremost, the Federal Reserve’s subsequent meeting is not scheduled until June 17, at which time it may implement either an increase or decrease in its federal funds rate. This could either increase or decrease demand for gold, contingent upon the bank’s decision.

Ben Nadelstein, the director of content at Monetary Metals, anticipates that it will be a significant event to observe. “The gold market could be influenced by any change in policy direction or even a shift in tone regarding future rate cuts.”

However, the probability of a rate change is only 5.6%, according to the CME Group’s FedWatch tool, as of May 27. Consequently, it is improbable that there will be a significant shift in favour of or against gold. Gold prices may be affected by the implementation of proposed tariffs following the Fed meeting, according to experts.

Brett Elliott, director of content at APMEX, a precious metals marketplace, has observed that gold prices have been responding more to headlines in recent months than to substantive changes in global conditions.

Gold prices may also decline, particularly if the Federal Reserve decides to raise rates at its June meeting (although this is not likely).

Elliott asserts that a rate increase from the Federal Reserve is improbable, but it is feasible if tariffs induce inflation and the labour market remains robust. “This type of reversal would induce capital flows from gold to treasuries.”

Additionally, fluctuations in geopolitical circumstances may induce a decline in gold prices.

Elliott suggests that gold prices may decrease if tariffs and trade conflicts are resolved amicably, central banks cease their gold purchasing activities, or the U.S. government exhibits fiscal restraint.

However, it is unrealistic to anticipate any significant consequences should they plummet.

James Cordier, CEO and lead trader at Alternative Options, asserts that central bank purchases are proceeding at an unprecedented rate. “This establishes a firm foundation for prices.”

Gold prices may experience a recovery.

If economic data released in June indicates a weakening economy, the Federal Reserve may be compelled to reduce rates. Cordier believes that this would provide the necessary impetus for gold prices to continue their upward trajectory.

Cordier asserts that a weaker prognosis will result in a demand for lower U.S. interest rates, which will in turn bolster gold demand as a softer dollar encourages purchasing. Furthermore, “any geopolitical events that significantly increase risk” could also cause gold prices to rise.

“Gold could reach new highs if trade negotiations stall, global tensions worsen, or the stock market corrects and lowers interest rate expectations,” Nadelstein asserts.

Source : cbsnews