West Red Lake Gold Mines’ VP of communications, Gwen Preston, recently spoke with David Lin and offered invaluable commentary on this changing scene. The gold market is undergoing fundamental changes, according to Preston, an experienced industry veteran.

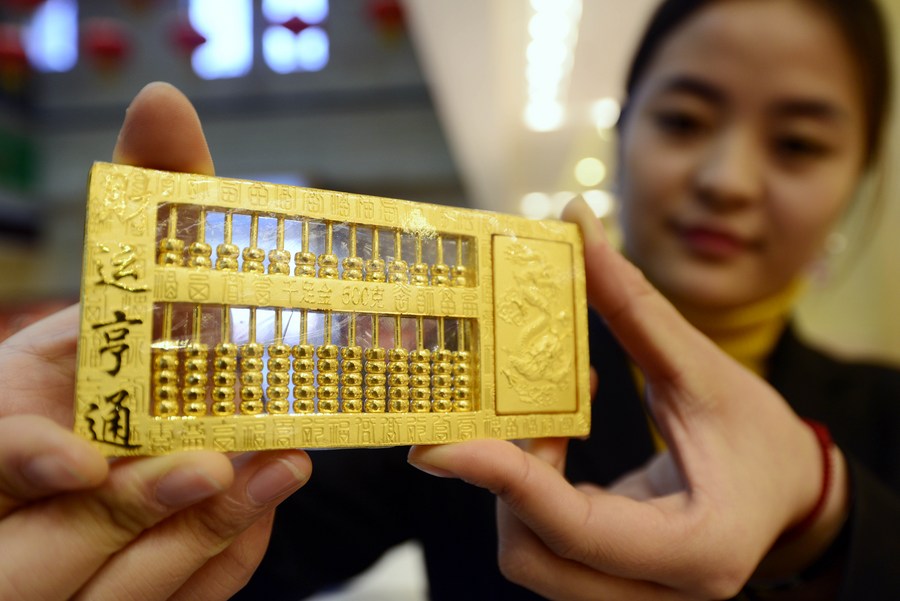

According to Preston, “The Chinese Central Bank is leading amongst those,” referring to the substantial influence that China’s gold purchases have had on international markets. “The Chinese Central Bank decided to start buying gold again… and it took us a while to all realise that that’s what was happening but that is exactly when the Chinese Central Bank started leaning back into the gold market.”

Investors around the world are fleeing to safe havens as a result of rising Asian demand, worries about de-globalization, and the dollar’s dwindling dominance. “I think that those forces that have propelled gold higher remain in play,” said Preston. “I think that on the western investor side of things… that awareness of… debt risk of dollar risk of geopolitical risk I think it’s rising.”

Preston thinks that only Asian customers will feel the effects of increasing interest rates on the gold market. “I don’t think it has any impact at all on the Chinese Central Bank or on all the Asian… Middle Eastern money that is going into gold,” said the woman.

The Gold Mines at West Red Lake

In addition, Preston gave an update on West Red Lake Gold Mines, mentioning that their pre-feasibility study for the Madson mine was recently released. “The pref feasibility study is the mine plan for the Madson mine,” according to her. “It produces almost 70,000 ounces of gold a year and it produces these numbers… it produces $70 million of free cash flow annually on average over those six years.”

An important milestone for West Red Lake Gold Mines is that the company is scheduled to begin gold production in the middle of this year. “We are well funded to get this mine back into operation,” Preston confirmed, highlighting the financial soundness of the organisation.

A number of variables are coming together to propel the gold market upward, such as strong demand in Asia, increasing investor anxiety, and a hospitable macroeconomic climate.

Preston dropped the bombshell that the bulk sample will be the next big thing. “We’re mining several areas and we’re batched stockpiling those bulk samples on Surface and we’re going to run those bulk samples through our Mill in March… we’ll be able to say we expected this and this and we got this and this that’s going to be an important Milestone so that news will be in April.”

Results from the bulk sample are soon to be released, which will confirm the production predictions made by the company and give investors more faith in West Red Lake Gold Mines’ future growth.

source: J post